What Is a Home Warranty?

Everything you need to know about home warranties—coverage, costs, and how to protect your home systems and appliances

Last Updated: February 2026

A home warranty is a service contract that provides repair or replacement coverage for major home systems and appliances that break down due to normal wear and tear. Unlike homeowners insurance, which protects against damage from fires, storms, and theft, a home warranty plan covers the everyday failures that happen as your home's components age and wear out. Home warranties offer valuable protection for homeowners who want to avoid unexpected repair bills.

Whether you're a first-time home buyer wondering if you should buy a home warranty, a homeowner considering protection for aging home appliances, or someone purchasing a home who wants coverage, understanding how home warranties work is essential. This comprehensive guide explains everything you need to know about home warranty coverage, costs, benefits, and how to choose a home warranty that fits your needs.

What Is a Home Warranty?

A home warranty is a contract (also called a home protection plan or home service contract) that provides coverage for home systems and appliances in your home. Home warranties cover the cost to repair or replace covered items when they malfunction or break down from normal use. In exchange for paying an annual premium and per-service fees, the home warranty provider agrees to handle repairs when a system or appliance fails.

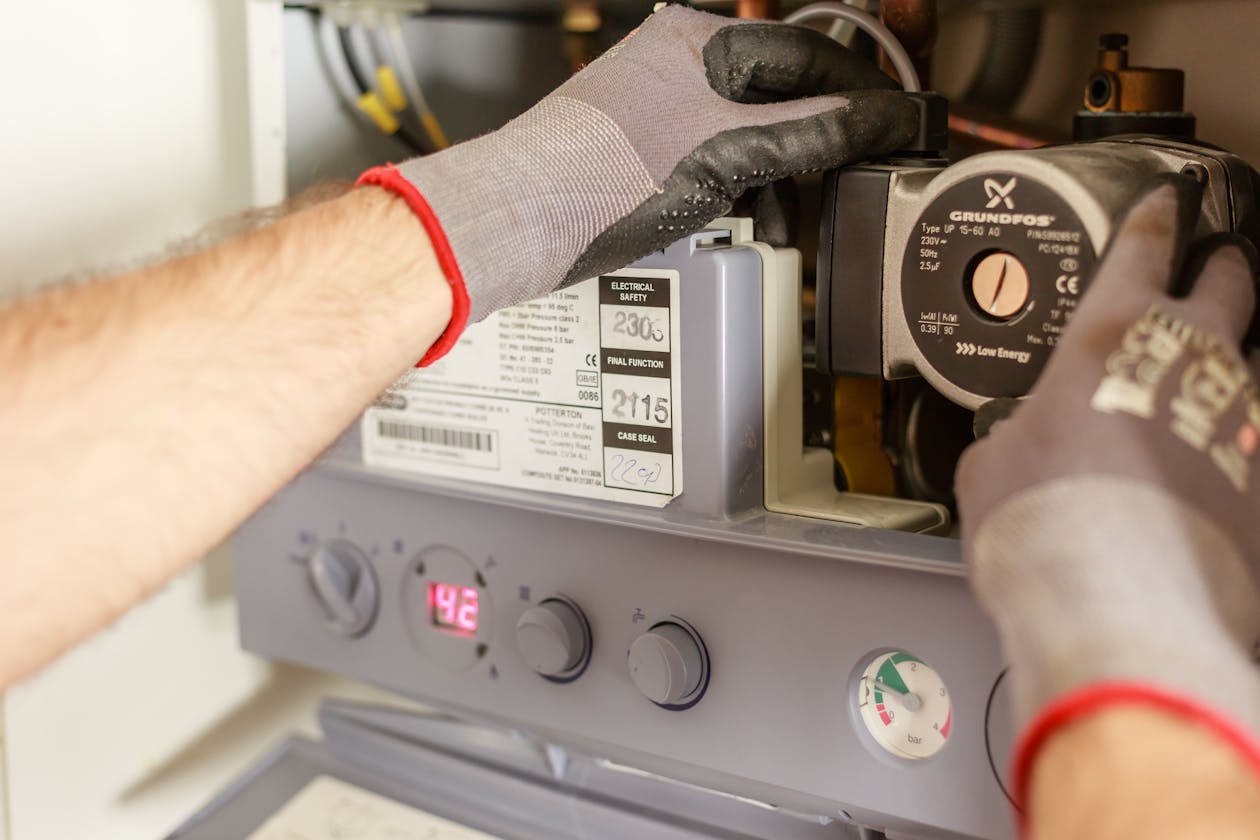

Think of home warranties as a maintenance and home repair service subscription. When your HVAC system stops working, your water heater fails, or your refrigerator breaks down, you contact your warranty company instead of searching for a contractor and paying thousands out of pocket. A home warranty can help protect your budget from unexpected repair costs. Home warranties often cover the critical home systems that keep your house running smoothly.

Key Takeaway

A home warranty is a service contract that covers the repair or replacement of home systems and appliances due to normal wear and tear. Home warranties aren't the same as homeowners insurance, which covers damage from unexpected events like fires or storms. Many home warranty companies offer different types of home warranty plans to fit various needs.

Three Types of Home Warranty Plans

Home warranty companies offer several coverage levels. Understanding the types of home warranty plans available helps you decide if a home warranty makes sense for your specific home:

- Systems-only plans: Home warranties cover major home systems like HVAC, plumbing, and electrical

- Appliances-only plans: These home warranties cover major appliances like refrigerators, washers, and dryers—similar to an appliance warranty

- Combination plans: Home warranties cover both systems and appliances (most popular choice)

- Comprehensive plans: These home warranties include additional items like pools, spas, and septic systems

How Home Warranties Work

Understanding how home warranty work helps you know what to expect when you need to use your coverage. Here's the typical process when you file a claim with your home warranty provider:

- Something breaks down: A covered home system or appliance breaks or stops working properly

- Contact your warranty company: Call the 24/7 hotline or submit a claim online to your home warranty provider

- Pay the service fee: When you file a claim, most companies require payment of the service call fee ($75-$125)

- Technician visits your home: The warranty provider assigns a licensed contractor from their network who will come to your home

- Diagnosis and repair: The technician evaluates the problem and performs covered repairs on your home system or appliance

- Replacement if needed: If the item cannot be repaired, the home warranty company may approve replacement

Home Warranty Service Fees (Trade Fees)

Every time you request home warranty service, you'll need to pay a service call fee (also called a trade service fee or deductible). This fee typically ranges from $75 to $125, depending on your home warranty plan. Some premium plans offer lower service fees in exchange for higher annual premiums.

The service fee covers the technician's visit and diagnosis. If the repair is covered by your home warranty, you won't pay anything beyond this fee, regardless of the actual repair cost. However, if the issue isn't covered by a home warranty, you'll be responsible for the full repair cost. Home warranties may not cover every situation, so understanding your contract is important.

Home Warranty vs. Home Insurance

The difference between a home warranty and home insurance is one of the most common points of confusion for homeowners. While both protect your home, they serve very different purposes:

| Feature | Home Warranty | Home Insurance |

|---|---|---|

| What it covers | Home systems and appliances that break down from normal use | Damage from fires, storms, theft, liability |

| Required? | Optional—you decide if a home warranty is right for you | Required by mortgage lenders |

| Cost structure | Annual premium + service fees | Annual/monthly premium + deductible |

| Average annual cost | $300-$600 for most home warranties | $1,500-$2,500 |

| Example claim | HVAC system fails from age | HVAC damaged by lightning strike |

Most homeowners need both types of coverage. Homeowners insurance is typically required by your mortgage lender and protects your home's structure and belongings. Home warranties are optional and provide peace of mind for the inevitable breakdowns that come with owning a home. When purchasing a home, consider getting a home warranty as added protection.

What Does a Home Warranty Cover?

Coverage varies by company and plan, but here's what home warranties typically cover. Find out what home warranties cover before you buy a home warranty:

Major Home Systems

Home warranties cover these critical home systems in your home:

- HVAC system: Heating, ventilation, and air conditioning components including furnaces, heat pumps, and ductwork

- Plumbing system: Interior pipes, drain lines, faucets, toilets, and garbage disposals

- Electrical system: Interior wiring, outlets, switches, and circuit breakers

- Water heater: Tank and tankless water heaters

- Ductwork: Heating and cooling distribution systems in your home

Major Home Appliances

Home warranties often cover these appliances in your home:

- Kitchen appliances: Refrigerators, ovens, ranges, cooktops, dishwashers, microwaves

- Laundry appliances: Washers and dryers (often optional coverage—check if covered by your home warranty)

- Garage door opener: Motor and mechanical components

- Ceiling fans: Motors and switches

Optional Add-On Coverage

Many home warranty companies offer additional coverage for extra cost. Home warranty companies offer add-ons for:

- Swimming pools and spas

- Septic systems

- Well pumps

- Second refrigerators or freezers

- Central vacuum systems

- Roof leak repair

What a Home Warranty Likely Won't Cover

Home warranties aren't comprehensive coverage for everything. A home warranty likely won't cover:

- Pre-existing conditions (problems that existed before coverage started)

- Improper installation or modifications

- Lack of home maintenance or neglect

- Cosmetic damage or defects

- Outdoor components (unless specifically included)

- Items still under manufacturer warranty or extended warranties

- Code violations or upgrades required by local codes

How Much Do Home Warranties Cost?

Understanding the true cost of a home warranty requires looking at what home warranty plan costs overall, including the annual premium and service fees:

Annual Premiums

Here's how much do home warranties typically cost for different coverage levels:

| Plan Type | Annual Cost Range | Average |

|---|---|---|

| Basic (Systems or Appliances) | $200-$400 | $300 |

| Standard (Systems + Appliances) | $350-$550 | $450 |

| Comprehensive (With Add-ons) | $500-$800 | $650 |

Home warranty cost depends on your location, coverage level, and the company offers. The average home warranty plan costs around $450 per year for combination coverage.

Service Call Fees

In addition to your annual premium, you'll need to pay a service fee each time you request a repair from your home warranty service:

- Economy plans: $100-$125 service fee

- Standard plans: $75-$100 service fee

- Premium plans: $50-$75 service fee

Lower service fees usually mean higher annual premiums for home warranties. Consider how many claims you expect to file when choosing your home warranty plan.

Pros and Cons of Home Warranties

Like any financial product, home warranties have advantages and disadvantages. Here's what to look for in a home warranty decision:

Advantages of Home Warranties

Budget Protection

Home warranties can provide predictable costs that help you budget for home repairs. A home warranty can help avoid a surprise $4,000 HVAC repair—instead you pay your annual premium plus a service fee. The value of a home warranty is peace of mind.

Convenience

No need to research and find a home repair contractor. Your home warranty provider handles finding qualified technicians who come to your home for covered repairs.

Peace of Mind

Home warranty coverage provides security knowing you won't face catastrophic repair bills for covered home systems. A home warranty can save you stress and money.

Home Sale Benefit

Sellers can offer home warranties to buyers as an incentive when buying or selling a home. Buyers gain protection during their first year of ownership with a new home warranty.

Disadvantages of Home Warranties

Coverage Limitations

Home warranties have exclusions, caps, and fine print that may limit what's actually covered by a home warranty. Read your contract carefully.

Claim Denials

Claims may be denied for pre-existing conditions, lack of home maintenance, or other reasons. Home warranties may not always pay out.

No Contractor Choice

You must use the home warranty company's contractors, who may not be the best in your area for your specific home issues.

Service Delays

Repairs may take longer as you wait for authorization from your home warranty provider and contractor availability.

Are Home Warranties Worth It?

Whether home warranties worth the cost depends on your specific situation. Here's how to decide if a home warranty makes sense for you:

Get a Home Warranty If:

- Your home or appliances are older: An existing home over 10 years old has systems approaching the end of their lifespan

- You're buying an existing home: Unknown history of home maintenance and potential hidden issues make home warranties valuable

- You have limited savings: Can't afford a sudden $5,000 repair bill without a home warranty

- You're not handy: Prefer to call someone rather than DIY repairs on your home systems

- Peace of mind matters: The value of a home warranty outweighs the cost for your peace of mind

Skip Home Warranties If:

- Your home is new: Most items are under manufacturer warranty or extended warranties

- You have an emergency fund: Can afford repairs without a home warranty by self-insuring

- You're handy with repairs: Can handle many fixes yourself without paying for a home warranty

- You prefer choosing contractors: Want control over who works on your covered home systems

Break-Even Analysis: Is a Home Warranty Worth It?

To determine if a home warranty is worth it financially, consider the break-even point:

- Annual home warranty plan costs: $450

- Two service calls at $100 each: $200

- Total annual cost of a home warranty: $650

- Break-even: If your home warranty pays for repairs totaling more than $650, paying for a home warranty was worth it

How to Choose a Home Warranty Company

With dozens of home warranty companies available, here's how to find a home warranty that fits your needs. When you want to buy a home warranty, consider these factors:

Compare Coverage and Costs

- Review what the warranty covers: Make sure the home warranty plan covers your specific home systems and appliances

- Check coverage caps: Some home warranties limit payouts per item or per year

- Understand service fees: Compare what you'll need to pay across companies

- Look at exclusions: Know what's NOT covered by your home warranty before you purchase a home warranty

Research the Company

Look for a reputable home warranty company by checking:

- Read customer reviews: Check BBB ratings, Google reviews, and complaint histories for home warranty companies

- Verify licensing: Ensure the home warranty provider is licensed in your state

- Check financial stability: Look for established home warranty companies with solid track records

- Review claim process: Understand how claims are handled by the home warranty company and typical response times

Questions to Ask Before You Buy a Home Warranty

- What's the claims process and average response time for the home warranty service?

- Are there coverage caps per item or per year for home warranties?

- What home maintenance records are required?

- How are repair or replace decisions made by the warranty provider?

- What happens when the warranty expires? What's the cancellation policy?

Filing a Home Warranty Claim

When something breaks in your covered home, follow these steps for a smooth home warranty claim experience:

Step-by-Step Claim Process

- Verify coverage: Check your contract to confirm the item is covered by your home warranty

- Contact your home warranty provider: Call their 24/7 hotline or file a claim online

- Provide details: Describe the problem with your home system or appliance, symptoms, and any error codes

- Pay the service fee: When you file a claim, most home warranty companies collect this upfront

- Schedule the appointment: Coordinate with the assigned contractor who will come to your home

- Be home for the visit: Show the technician the issue and provide access to systems in your home

- Get documentation: Request a copy of the diagnosis and repair report

Tips for Successful Home Warranty Claims

- Keep your home maintenance records: Document regular home maintenance to avoid denial—this helps prove you didn't neglect your home

- Take photos: Document issues before and after service calls for your home warranty

- Follow up promptly: If repairs don't resolve the issue, contact the home warranty company immediately

- Know your rights: Understand the appeals process if a home warranty claim is denied

Pro Tip: Keep Your Home Maintained

Keep a home maintenance log and save all service records. If a home warranty claim is ever disputed, documentation of proper home maintenance can be the difference between approval and denial. Home warranties may deny claims if you can't prove regular maintenance.

Home Warranties for Buyers and Sellers

Home warranties play a unique role in real estate transactions when buying or selling a home:

For Home Buyers

A new home warranty for new homeowners provides valuable protection during your first year of ownership. When you buy a home (especially an existing home), you inherit systems and appliances with unknown histories. A home warranty can provide protection against unexpected failures.

Many sellers offer to pay for the buyer's first year of home warranty coverage as part of the purchase agreement. If the seller doesn't offer a home warranty, you can:

- Request a home warranty as part of your offer negotiations when purchasing a home

- Ask your real estate agent to help negotiate home warranty coverage

- Purchase a home warranty yourself at closing

For Home Sellers

Offering a home warranty for buyers when selling can benefit sellers in several ways:

- Makes your listing more attractive: Buyers appreciate the added protection of home warranties

- Reduces liability: If something breaks shortly after closing, the home warranty handles it

- Shows confidence: Suggests you've maintained the home well with proper home maintenance

- May help sell faster: Removes buyer concerns about older home systems

Sellers can also get a home warranty during the listing period to protect against repairs while the home is on the market.

Related Guides

Frequently Asked Questions About Home Warranties

What is a home warranty and how does it work?

A home warranty is a service contract that covers the repair or replacement of major home systems and appliances that break down due to normal wear and tear. When a home system or appliance breaks, you file a claim with your warranty provider, pay a service fee (typically $75-$125), and a technician visits your home to fix or replace the item. Home warranties aren't the same as homeowners insurance, which covers damage from events like fires or storms.

How much does a home warranty cost?

The average home warranty plan costs between $300 and $600 per year, with the average cost of a home warranty around $450 annually. Home warranty cost depends on your coverage level, home size, and location. You'll also need to pay a service call fee of $75-$125 each time you request a repair. Enhanced coverage plans can cost $600-$800 or more per year.

What's the difference between a home warranty and home insurance?

The difference between a home warranty and home insurance is significant. Home insurance (homeowners insurance) covers damage from unexpected events like fires, storms, theft, and liability. A home warranty covers the repair or replacement of home systems and appliances that fail from normal wear and tear. You need both for complete protection—home insurance protects your home's structure and belongings, while home warranties cover breakdowns of working components.

What does a home warranty typically cover?

Standard home warranty coverage includes HVAC systems (heating, ventilation, air conditioning), plumbing systems, electrical systems, water heaters, and major home appliances like refrigerators, ovens, and dishwashers. Many home warranty companies offer optional coverage for pools, spas, septic systems, and additional appliances like washers and dryers. Always check what's covered by your home warranty before purchasing.

Is a home warranty worth it?

A home warranty is worth considering if you have older appliances or systems, limited emergency savings, or peace of mind is important to you. The average homeowner spends $1,000-$2,000 annually on home repairs. If your home warranty plan costs $450 plus service fees and prevents a $3,000 HVAC repair, the home warranty can help save you money. However, if your home is newer or you're handy with repairs, you might save money without a home warranty by self-insuring.

Do home warranties cover pre-existing conditions?

Most home warranties do not cover pre-existing conditions—problems that existed before your coverage started. However, home warranties may cover unknown pre-existing conditions if the issue wasn't apparent during a home inspection and the system was in working order when coverage began. A home warranty likely won't cover issues that resulted from lack of home maintenance. Always review the specific terms of your warranty contract.

Can I choose my own repair technician with a home warranty?

Most home warranty companies require you to use their network of approved contractors. You typically cannot choose your own technician when you have a home warranty. The warranty provider dispatches a contractor from their network, which ensures quality control but limits your choice. Some premium plans from reputable home warranty companies offer flexibility, but it's rare.

How long do home warranties last?

Home warranties are typically annual contracts lasting 12 months. Most home warranty plans automatically renew unless you cancel before the warranty expires. When buying or selling a home, sellers often provide a new home warranty that covers the buyer's first year of ownership. You can renew or purchase a home warranty each year to maintain coverage on your existing home.

The Bottom Line on Home Warranties

A home warranty can be a valuable tool for protecting your budget against unexpected repair costs for major home systems and appliances in your home. Whether you're a first-time buyer looking to buy a home, a homeowner with aging systems, or someone who values peace of mind, the right home warranty plan can provide meaningful protection.

Before you purchase a home warranty, carefully review coverage details, compare multiple home warranty companies, and calculate whether the costs align with your expected needs. For many homeowners, especially those with older homes or limited emergency funds, home warranties are worth the investment. The best home warranty for you depends on your specific home and situation.

Need help navigating the home buying process? Find a local real estate agent who can guide you through everything from home warranties to closing, ensuring you're protected every step of the way.